Editor’s note: Seeking Alpha is proud to welcome Value Quest as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

shaunl/iStock via Getty Images

Investment Thesis

Fidelity National Financial , Inc. (NYSE:FNF) provides title insurance and settlement services. Currently, the finance and insurance industry is under selling pressure because of the rising interest rates. FNF has the policy of stable spread, making it well-positioned in the industry with limited potential risk. The company currently has a 4.7% dividend yield, making it a stock to hold. After considering all these factors, I recommend holding this stock for the long term.

About Company

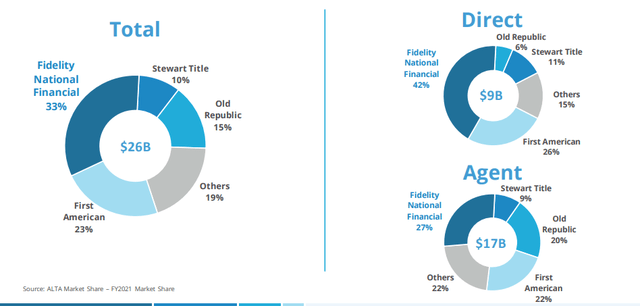

Fidelity National Financial, Inc. offers transaction and title insurance services to real estate and mortgage companies. FNF is the largest title insurance business in the country through its title insurance underwriters such as Fidelity National Title, Chicago Title, Commonwealth Land Title, Alamo Title, and National Title of New York. Deferred annuities are also offered by the company through its wholly-owned subsidiary, FGL Holdings (F&G). FNF is a market leader with 33% of the market share.

Market Share (Investor Presentation)

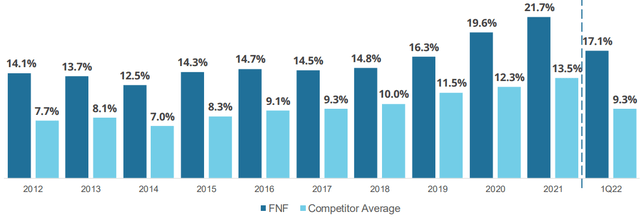

The company earns a large portion of its revenue from agency title insurance premiums which is 33% of total revenue. Escrow, title-related and other fees generate 31% of the revenue, while a direct title insurance premium contributes 23% to its revenue and Interest and investment income is 13% of the total income. The company has been a market leader for a long time, which has helped it expand its margin higher compared to the industry average. This has given a competitive edge to the company and makes it well-positioned in the industry as compared to its peers.

FNF Margins as compared to competitor (Investor Presentation)

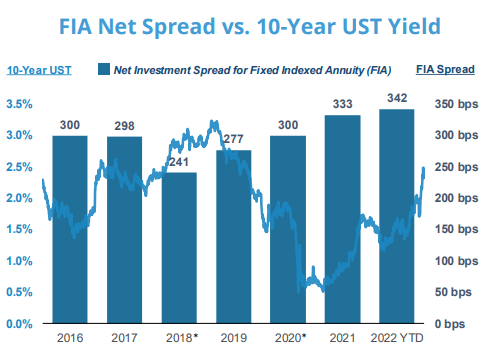

Stable Spread

The company has maintained a long track record of consistent spread, which helps the company to mitigate the cyclical nature of the industry and to keep the income stable. I believe this strategy has a flaw of losing customers in a low yield scenario, but the growing income trend shows us that company has managed to counter it with its competitive edge and unbeaten market share.

FIA Net Spread vs 10-Year UST Yield (Investor Presentation)

As we all know, all the mortgage businesses are currently facing a headwind from a dramatic decline in refinancing proposals resulting from rising interest rates. The interest rates have reached an average of 5.90%, which has adversely affected the real estate refinancing application. The earning flow of the company is more dependent on low rate-sensitive services such as residential purchase, commercial, and non-title information businesses, and there is still a huge demand for new residential purchases, which has created a supply deficit and price hikes. I know that this limited inventory problem is temporary, and soon the prices and demand are likely to go down, but with a stable spread and the highest margins in the industry, FNF looks better positioned to navigate all the negative news in the industry. I believe the stable spread policy of FNF will attract more consumer applications in the coming quarters because of rising rates in the market.

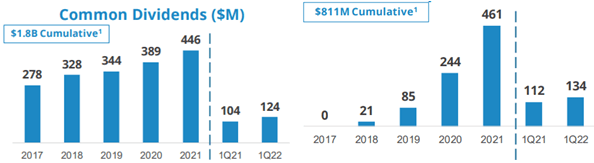

Strong Dividend Yield and Share Repurchase Program

FNF’s capital deployment policy focuses on giving a maximum return to its shareholder by either investing in business or return of capital to shareholders. The company has a long history of growth and high dividend payments, and it is currently paying a quarterly dividend of $0.44 per share, equivalent to a 4.7% annualized dividend yield. I believe a strong 4.7% dividend yield in the current economic scenario is very helpful in mitigating the stock market slowdown. Currently, the company has $500 million approved as an annual dividend, which seems sustainable in the long term.

Dividend and Share Repurchase of FNF (Investor Presentation)

During the first quarter, FNF completed the repurchase of 2.75 million shares at an average price of $48.68 per share, for a total expenditure of $134 million. In addition, FNF disclosed its intention to proceed with a transaction that will involve the proportionate distribution of a 15% ownership stake in F&G among FNF shareholders. I believe the stable dividend is sustainable despite the impact of the increasing interest rate.

Analysis of Financial Statements

FNF declared Q1 2022 results on May 11 for the quarter ending March 31. The company reported $3.16 billion in revenue as compared to $3.1 billion in Q1 2021. The company saw revenue growth across all segments, but the most significant was in Escrow earnings, a 51.5% increase as compared to Q1 2021. The reason for flat revenue is a one-time recognized loss of $469 million. The company reported an income of $399 million, a 34% decline from the year-ago period, given the increased expenses owing to policy reserve changes by the firm. The company reported diluted EPS of $1.40 compared to $2.08 in Q1 2021, a 32% decline. This decline was driven mainly by the decline in Title’s refinancing volumes. As per my analysis, the results were not quite impressive, and the gross margins saw a significant decline. The company estimates the Q2 2022 EPS in the range of $1.43-$1.55. The future outlook seems quite conservative, and I don’t see much growth from current levels.

The company’s balance sheet looks normal, and I don’t see any alarming factor in it. The company reported cash and equivalents of $2.79 billion. The company doesn’t have any long-term secured debt, but the company has future policy benefits, which can be treated as a long-term liability. I believe in future; the company will focus on its cash levels and try to maintain them above $3 billion level.

Mike Nolan, Chief Executive Officer, said:

I am pleased with the stability of our Title business, as we delivered adjusted pre-tax title earnings of $437 million and an adjusted pre-tax title margin of 17.1% in the first quarter, despite significant uncertainty and volatility in the macro environment. Strength in residential purchase and commercial revenue helped to buffer the ongoing contraction in refinance volumes, which hold a significantly lower fee per file. Looking ahead in 2022, we believe that we are well-positioned to navigate the effects of a rising interest rate environment, with scale advantage as the nationwide market leader, efficiencies from our innovative technology enabled platform, and a disciplined operating strategy and proven track record of quickly adjusting our operating model for significant fluctuations in opened and closed orders.

The management believes that it has been able to mitigate the effects of the economic slowdown to a great extent, and it expects to continue in the coming quarters. But as per my analysis, the scope for growth is minimal given the rising inflation coupled with higher interest rates. But given the strong dividend yield of 4.67% and stable price levels of FNF, I think the investors who have a position in the stock should hold it for now.

What are the risks faced by FNF?

Economic and Credit Market Conditions

The company’s investment depends on its portfolio, subject to market and economic risks such as changes in interest rates, credit markets, and the cost of tradable equities and fixed-income assets. The title business is set up to provide appropriate liquidity, adhere to internal and regulatory regulations, and maximize overall return through investment income and capital appreciation coupled with a low risk of principal. A stable spread reduces the effect of interest rates, but foreign investments are still vulnerable to changes.

Dependency on Financial Institution

The company maintains segregated bank accounts for the monies customers have left in escrow at various financial institutions. It has a $30.5 billion contingent liability related to the proper disposal of these balances. There is no assurance that the company would be able to restore the amounts placed, whether via Federal Deposit Insurance Corporation coverage or otherwise, should one or more of these financial institutions fail. I believe the risk of this event is limited as the company has already made the deposits to various institutes, which reduces the probability of this event.

Technical Outlook

Technical Analysis Chart of FNF (Investing.com)

The technical indicators suggest that the stock is trading below its 50-day and 100-day weighted moving average (WMA). Unless the stock price breaks above the 50-day moving average, it is not advisable to make new positions in the stock as there is no strong momentum in the long-term chart. As per RSI, the stock has crossed a lower range of $30 and is currently consolidating between the $50 and $35 price range. I believe once the stock crosses the $50 price level, we will see fresh momentum. Overall, as per the technical parameters, I suggest holding the stock at the current price and not making any fresh positions.

Fundamental Valuation

I believe the company will benefit from a stable spread and strong dividend growth and will be well-positioned in rising interest rates scenario. The company currently trades at $37.69 per share and a PE multiple of 4.89x. I am assuming the EPS and PE multiple estimates for the FY2023 will be $6.10 and 8.5x, respectively. After considering both estimates, the target price for the FNF will be $51.85 (PE multiple for 2023 * EPS estimate for 2023), representing 37.5% returns from the current share price of $37.69. I am assuming a decrease in the EPS as compared to the FY2021 and FY2022 because the interest rates are continuously rising, reducing the housing demand. The company is currently paying a 4.7% dividend yield which I believe makes it a company to hold for the long term to protect the portfolio in a possible recessionary environment.

Conclusion

FNF is well-positioned with stable spread in the finance and insurance industry, but current macro-elements of the economy are putting pressure on revenue and profit margins of the firm, thus restricting earning growth. The company pays a healthy dividend of 4.7%, but the stock price is adjusting itself with current negative news of rising interest rates. After considering all these factors, I assign a hold recommendation for the stock.

More Stories

3 Ways To Finance Your Business Without Credit Cards

10 Things a Small Business Can Write Off

How to Finance Your Business