There is no denying the impression of the pandemic is nevertheless remaining felt by...

Payment

Extra than six months immediately after Kirby Sensible delivered Ga soccer its initial nationwide...

(Bloomberg) — Right after 5 weeks in hiding, the disgraced founders of 3 Arrows...

Israel Aerospace Industries has documented that it has signed a contract worthy of...

To grow your social media presence on TikTok safe and early, here are the...

A lot more than fifty percent of the country’s significant businesses fall short to...

Among the Israeli technological know-how businesses that were merged into Wall Avenue-traded SPACs...

Chinese actual estate builders, including hugely indebted Evergrande, have operated a organization that relied...

The AEW Globe Tag Crew Championship victory for Swerve In Our Glory (Keith Lee...

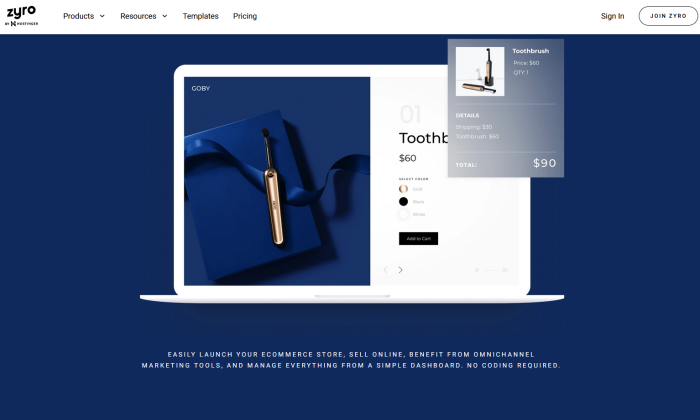

Disclosure: This content is reader-supported, which means if you click on some of our...